- Changed the procedure to handle monthly updates to the IRS segment rates. New rates are now picked up from the IRS Notice (e.g. Notice 2025-21) instead of from these web sites:

-- IRS web site for minimum present value segment rates (is not timely updated).

-- IRS web site for pension plan funding segment rates (is not timely updated).

-- IRS web site listing segment rate notices (is not timely updated). - Added pension plan funding segment rates including associated functions, tables, and charts. Previously the add-in handed only the minimum present value segment rates.

- Added the newly released PUB-2016 mortality tables.

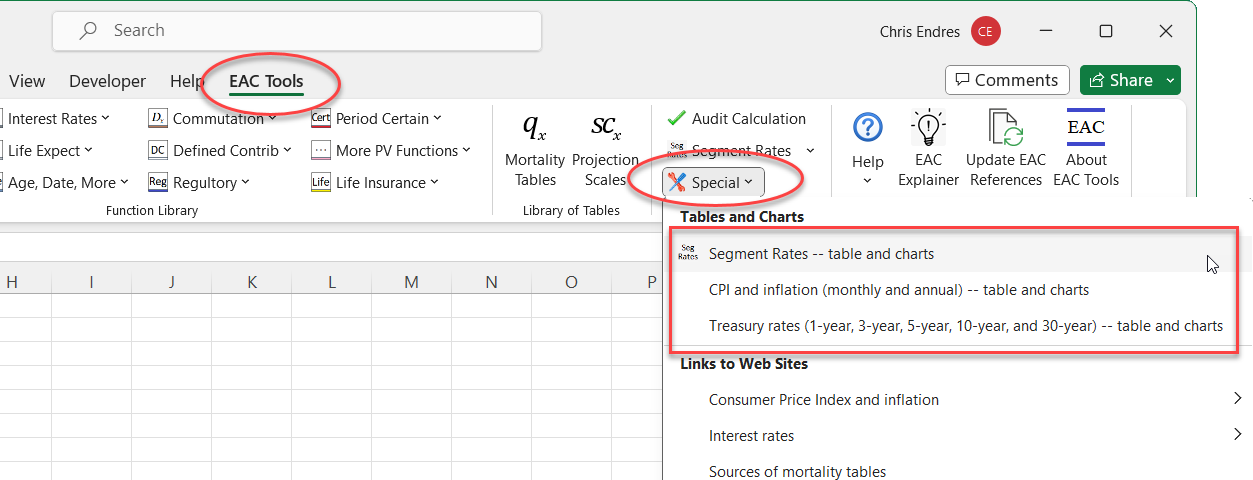

- The procedure for updating the following items has been completely revamped:

-- monthly updates to segment rates, treasury rates, yield curve rates, CPI values, etc.

-- annual updates for Social Security wages base, national average earnings, COLA

Rather than relying on the user to perform data downloads and “screen scrapes” from various websites, the process is now automated on an EAC computer. The data is contained in an Access database file that is uploaded to the EAC FTP server. In order to get the updates, the user needs to simply a button to download this one file -- no other work is performed on the user's computer. The download occurs very quickly, because the file is only 4.7KB.

- New function CCPIU returns the C-CPI-U All Urban Consumers (chained CPIU).

- New function HighAvg returns the highest value averaged over n-years from an array of values.

- New function SegRateARPA returns the Post-ARP/IIJA adjusted 24-month average segment rate under §430(h)(2).

- New function SegRatePPAMax returns the Post-ARP/IIJA unadjusted 24-month average segment rate under §430(h)(2).

- New function PVJL3 returns the present value of a joint life annuity for three lives (payments stop at the first death).

- Modified the functions Catchup and Catchup to add an optional age parameter. The SECURE 2.0 Act of 2022 allows larger contributions for age 60 to 63.

- Faster Excel start-up! When Excel is launched, the add-in is automatically loaded. The add-in then does the following:

-- checks to see if there is a new version

-- checks to see if new segment rates are available (at the user's option this can be disabled)

-- loads the add-in's menu to Excel's menu

-- registers all of the EAC functions

All of this happens very quickly due to reduced file sizes and efforts to improve efficiency. - Corrected the projection of IRALimit for future years. This is based on C-CPI-U instead of CPI-U.

- Removed changing the calculation mode to auto at startup. The calculation mode at startp will be set according to standard Excel protocol.

RSS Feed

RSS Feed